3D printing is one of the most exciting and revolutionary technologies of our time. It allows companies to create physical objects layer by layer, using materials like plastic, metal, and even concrete. From toys to car parts and even medical implants, 3D printing is transforming industries. But did you know that you can invest in this technology by buying 3D printing stocks? By investing, you can become part of the growth story of this incredible innovation.

In this blog, we’ll explore some of the best 3D printing stocks to consider, explain why they’re worth watching, and show you how to get started. Don’t worry if you’re new to investing—we’ll keep it simple and easy to understand. Let’s dive in and see how 3D printing could shape not just the future, but also your financial portfolio!

What Is 3D Printing and Why Is It Important?

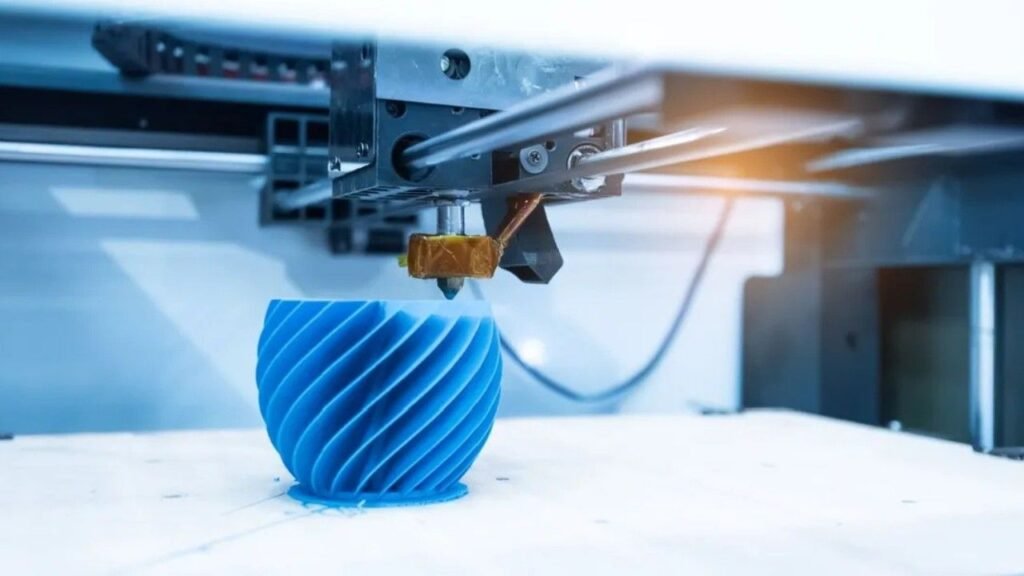

3D printing, also known as additive manufacturing, is the process of making three-dimensional objects from a digital design. Unlike traditional manufacturing methods that cut or mold materials, 3D printing builds objects layer by layer. This method is:

- Cost-Effective: It reduces waste and lowers production costs.

- Customizable: Products can be made to exact specifications.

- Fast: Prototypes and final products can be created quickly.

Industries like healthcare, automotive, aerospace, and consumer goods are using 3D printing to innovate and improve their products. As the technology grows, so does its potential to generate profits, making 3D printing stocks an attractive investment.

Top 3D Printing Stocks to Watch

1. Stratasys Ltd. (Ticker: SSYS)

Stratasys is one of the leading companies in the 3D printing industry. It specializes in industrial-grade printers and materials, making it a favorite for businesses that need high-quality 3D printing solutions.

Why Invest in Stratasys?

- Strong reputation for innovation.

- Partnerships with major brands like Airbus and Ford.

- Focus on sustainable 3D printing solutions.

Growth Potential: Stratasys is expected to benefit as more companies adopt 3D printing for manufacturing and prototyping.

2. 3D Systems Corporation (Ticker: DDD)

3D Systems was the first company to introduce 3D printing to the world. Today, it remains a pioneer, offering a wide range of printers, materials, and software solutions.

Why Invest in 3D Systems?

- Long history of innovation.

- Strong focus on healthcare applications like dental and surgical tools.

- Diversified revenue streams.

Growth Potential: With its focus on high-margin industries like healthcare, 3D Systems has significant room for growth.

3. Desktop Metal (Ticker: DM)

Desktop Metal is a newer player in the 3D printing space but has quickly gained attention for its focus on metal 3D printing. Its technology is ideal for industrial manufacturing.

Why Invest in Desktop Metal?

- Advanced metal printing technology.

- Growing customer base in aerospace and automotive industries.

- Strong focus on sustainability.

Growth Potential: As industries shift to greener manufacturing practices, Desktop Metal’s innovative solutions make it a strong contender.

4. Protolabs (Ticker: PRLB)

Protolabs combines 3D printing with digital manufacturing to provide rapid prototyping services. Its unique approach makes it a go-to choice for companies needing quick production solutions.

Why Invest in Protolabs?

- High customer satisfaction.

- Strong focus on small-batch production.

- Diverse manufacturing services.

Growth Potential: Protolabs stands out for its ability to deliver fast, high-quality prototypes, giving it a unique edge in the market.

How to Invest in 3D Printing Stocks

1. Research the Companies

Before investing, learn about the company’s products, financial performance, and growth strategy. Look for companies with:

- Innovative technologies

- Strong partnerships

- Positive financial trends

2. Open a Brokerage Account

To buy stocks, you need a brokerage account. Many platforms, like Robinhood, E*TRADE, and TD Ameritrade, make it easy to start investing.

3. Diversify Your Investments

Don’t put all your money into one stock. Spread your investments across multiple companies to reduce risk.

4. Keep an Eye on the Market

Stay updated on industry trends and company news. This will help you make informed decisions about when to buy or sell.

Factors Driving the Growth of 3D Printing

1. Increasing Adoption in Industries

Industries like healthcare, automotive, and aerospace are rapidly adopting 3D printing for its efficiency and customization.

2. Cost-Effective Manufacturing

3D printing reduces material waste and production costs, making it an attractive option for businesses.

3. Technological Advancements

As 3D printing technology improves, it becomes faster, more accurate, and more versatile, expanding its applications.

4. Sustainability

3D printing supports greener manufacturing practices by using fewer resources and producing less waste.

Risks to Consider When Investing

Like any investment, 3D printing stocks come with risks. Here are some factors to keep in mind:

- Market Competition: The 3D printing industry is growing, but it’s also highly competitive.

- Volatility: Stock prices can fluctuate due to market trends and company performance.

- Regulation: Changes in regulations could impact the industry.

To minimize risks, do thorough research and consider consulting a financial advisor.

Frequently Asked Questions (FAQs)

Q1. Is 3D printing a good long-term investment?

Yes, 3D printing has significant growth potential, especially as more industries adopt the technology.

Q2. How much money do I need to start investing?

You can start with as little as $10, depending on the brokerage platform you use.

Q3. Can I invest in 3D printing companies outside the U.S.?

Yes, many international companies are involved in 3D printing. Research their performance before investing.

Conclusion: Shape Your Future with 3D Printing Stocks

3D printing is more than just a cool technology; it’s a growing industry with massive potential to change the world. By investing in top 3D printing stocks like Stratasys, 3D Systems, Desktop Metal, and Protolabs, you can be part of this exciting journey. Remember to do your research, diversify your portfolio, and stay updated on industry trends.

Start your investment journey today and watch your portfolio grow alongside this revolutionary technology!